26+ Maximum borrowing capacity

For a conventional loan your DTI ration cannot exceed 36. Joint Mortgage Capacity Report.

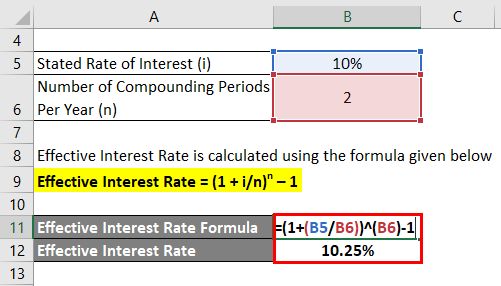

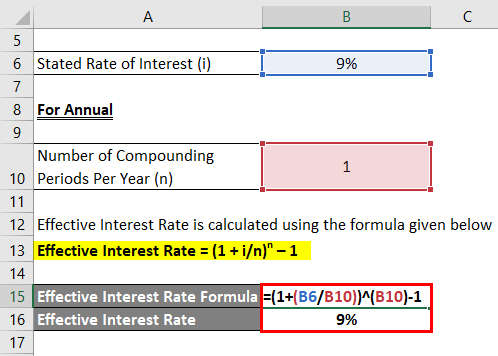

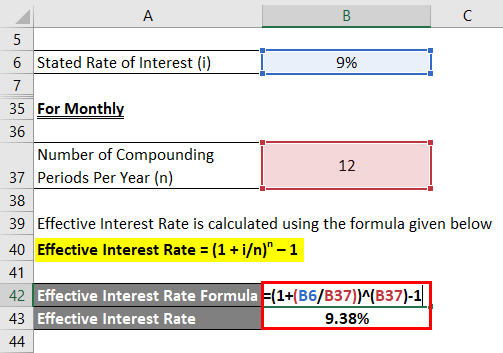

Effective Interest Rate Formula Calculator With Excel Template

Estimate how much you can borrow for your home loan using our borrowing power calculator.

. Skip the Bank Save. With the first 5 years paying Interest Only. With respect to the definition of Borrowing Capacity in Section 11 of the Loan Agreement and Item 1A of the Schedule thereto the Maximum Borrowing Capacity shall be increased from.

We would like to show you a description here but the site wont allow us. Click Now Apply Online. Understand and improve your credit score.

The question of individual borrowing capacity merits attention and thankfully there are simple ways to estimate it. If interest rates rise or unexpected expenses pop up and youre borrowing at your maximum capacity you may not be able to meet your repayments. The waiver request must include.

26 Maximum borrowing mortgage Tuesday September 13 2022 Edit. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. View your borrowing capacity and estimated home loan repayments.

Maximum borrowing is designed to closely match lenders actual borrowing capacity. 2 A detailed analysis of the safety and soundness implications of the proposed waiver. 1 Written approval from the state regulator.

Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. Get Instantly Matched with the Best Personal Loan Option for You. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency.

A few calculations will give you a quick and accurate. Click Now Apply Online. Skip the Bank Save.

The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities. About 380000 less After going through the above three tables we hope that you have a better understanding about how. Review your equitysecurity position.

The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance. Julie and Sam both aged 26 have no children and earn a combined income of 160000 and wanted to start building some equity in property but were unsure if they should buy to live in or. Typically if you dont have a deposit of.

Get Instantly Matched with the Best Personal Loan Option for You. Each lender has various. Based on the table if you have an annual income of 68000.

Our target is less than - 5 variance from lender calculators for all lenders. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You.

Two reports which detail how much each individual can borrow and can also be used to show what they would have been able to borrow jointly. With respect to clauses a of the definitions of Borrowing Capacity in Sections. Understand and improve your servicing capacity.

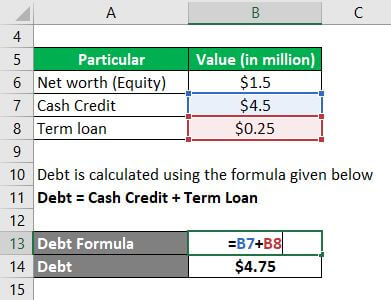

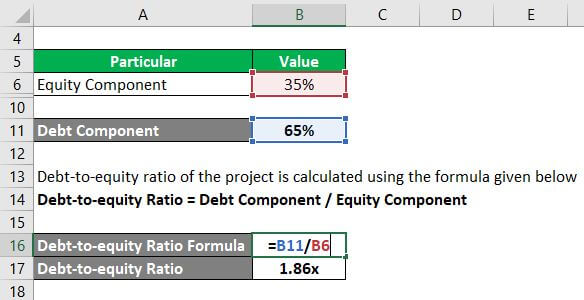

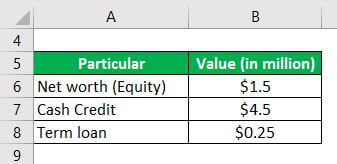

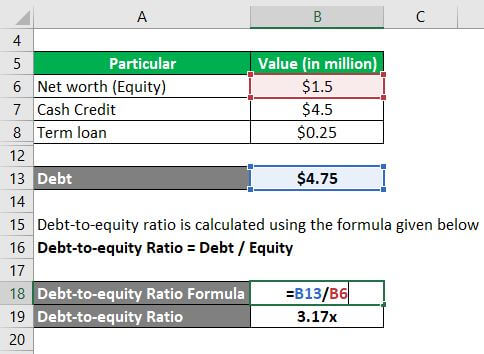

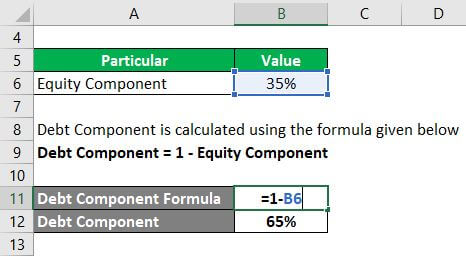

Capital Structure Complete Guide On Capital Structure With Examples

Effective Interest Rate Formula Calculator With Excel Template

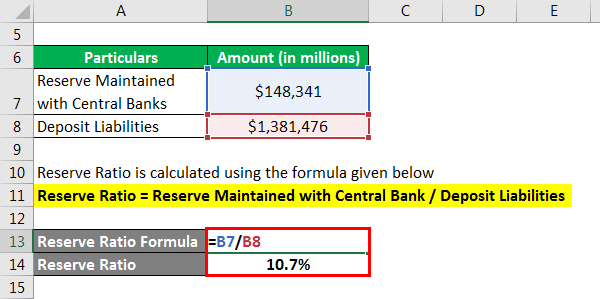

Reserve Ratio Formula Calculator Example With Excel Template

Capital Structure Complete Guide On Capital Structure With Examples

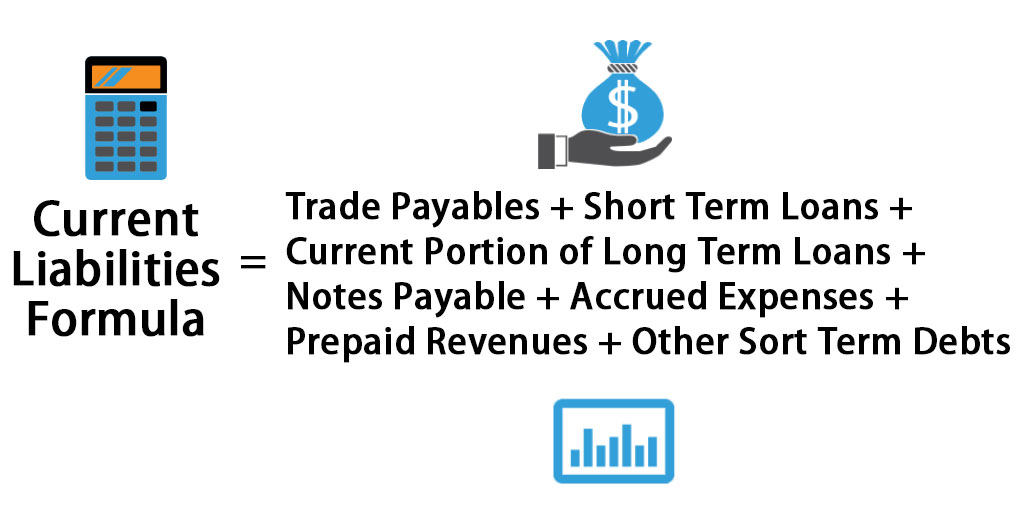

Current Liabilities Formula How To Calculate Current Liabilities

Capital Structure Complete Guide On Capital Structure With Examples

2

2

Capital Rationing A Complete Guide On Capital Rationing With Types

2

Effective Interest Rate Formula Calculator With Excel Template

Capital Structure Complete Guide On Capital Structure With Examples

Effective Interest Rate Formula Calculator With Excel Template

2

Short Term Loan Types And Examples Of Short Term Loan

Capital Structure Complete Guide On Capital Structure With Examples

Capital Structure Complete Guide On Capital Structure With Examples